This post is an analysis of the Washington State GET (Guaranteed Education Tuition) program. The main question we want to answer is whether to invest in GET or Vanguard 529 or both.

GET Resources:

https://www.get.wa.gov/sites/default/files/documents/2017-18-GET-Enrollment-Guide.pdf https://www.get.wa.gov/sites/default/files/documents/Program%20Details.pdf

Click to access Tuition-Payout-Over-Time-Chart-2018.pdf

Refer to docs above if you are wondering from where I am getting some of the numbers in the analysis below:

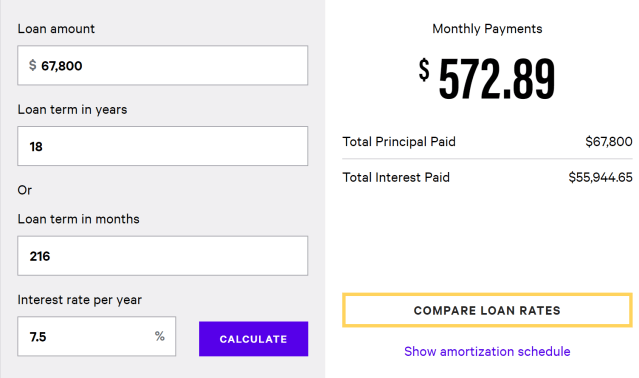

600 units will cost 600*113 = $67,800 if you were to buy them lump sum today. Spread this cost over 18 years or 216 months and you get 67800/216 = $314 per month. But because of the finance charge and other fees you lock in at $570 per month effectively resulting in a “premium” of 82%. This does not sound like a good deal.

If we assume 5.75% increase in tuition every year, then 18 years from now, the payout of 600 units will be (1.0575^18)*106.01*600=$173,998. The payout of 1 GET unit today is $106.01 source: https://www.get.wa.gov/pricepayoutfees

compare to the amount you put in 570*18*12 = $123,120. So the bet is that you can save $50,878 if you start contributing to GET now @$570/month.

Or you could even purchase all 600 units today @$67,800. If you do that, then the money will effectively earn a ROI of 5% as shown below:

>> math.exp(math.log(173998.0/67850)/18)

1.0537

In above I added $50 enrollment fee to $67,800

5% ROI is not that great but guaranteed assuming tuition rises 5.75% per year. If tuition increases by more than 5.75% ROI will be even more. E.g., if we assume 6% increase in tuition per annum, that gives an ROI of 5.6% and the value becomes $181,553 at end of 18 years.

It can be shown (see https://www.key.com/personal/calculators/annual-rate-of-return-calculator.jsp) that if you invest $475 per month in vanguard and assume 6% annual rate of return then after 18 years that money will grow into $181,000.

Conclusion:

- If one were to invest a fixed amount monthly then vanguard 529 is definitely better than investing in GET since investing $475 per month in vanguard has same effect as investing $570 per month in GET per above. The reason why GET is so expensive is because of their 7.5% finance charge. When you setup monthly payments to purchase 600 units over 18 years what happens is that GET gives you a loan and you have to pay 7.5% interest on that loan – its the same as buying a house. Using the calculator at https://www.bankrate.com/calculators/mortgages/loan-calculator.aspx

Unfortunately GET has no mechanism to run a credit on the applicant and set the finance charge based on applicant’s creditworthiness. This is the reason for taking one star out of its rating at savingforcollege.com. Otherwise its a 5 star program equivalent to vanguard 529. - But if one wants to make a single lump sum contribution then both options (vanguard vs GET) are comparable since in both cases I expect the money to earn a ROI of approx 6%. And so in this case the decision of choosing vanguard vs GET should be based on customer service – things like how easy it will be to take out distributions from the two accounts etc. Note that if you are willing to bet that you can earn a higher ROI on the money you put in vanguard than the expected rise in cost of tuition, then you should invest in vanguard 529 instead (and vice-versa) i.e. let

where

your expected rate of return if you put money in vanguard

the rate at which you expect tuition cost to increase in state of Washington

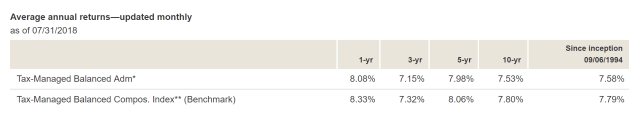

Go with Vanguard if you thinkand vice-versa. For context, the annualized rate of return for VTMFX if we look back at last 10 years is 7.5%

However as with mutual funds, past performance is not an indicator of future success and actual returns will vary.

Historical data shows tuition is rising @6% per annum in Washington state. source: https://www.get.wa.gov/sites/default/files/documents/Tuition-Payout-Over-Time-Chart-2018.pdf

>> math.exp(math.log(10601.0/3641)/18)

1.0611695668730086

Historical data shows University of California tuition is increasing @7.3% annually

>>> math.exp(math.log(14419.0/4034)/18)

1.0733300576326157

source: http://budget.ucdavis.edu/studentfees/historical/archive.html

So ultimately GET and Vanguard 529 come in at two different angles. With GET you want Washington state college tuition to rise in future to maximize your ROI whereas with Vanguard its the opposite. Vanguard 529 is a savings plan whereas GET is a prepaid tuition program – it essentially allows you to pay for future education at today’s price.

Further Reading:

https://www.bogleheads.org/forum/viewtopic.php?t=229180

https://www.savingforcollege.com/529-plans/washington/guaranteed-education-tuition-get?821=t

Should I rollover my GET units to Washington’s new 529 Dream Ahead Investment Plan?